The platform shift of AI and its propensity to create venture-scale winners

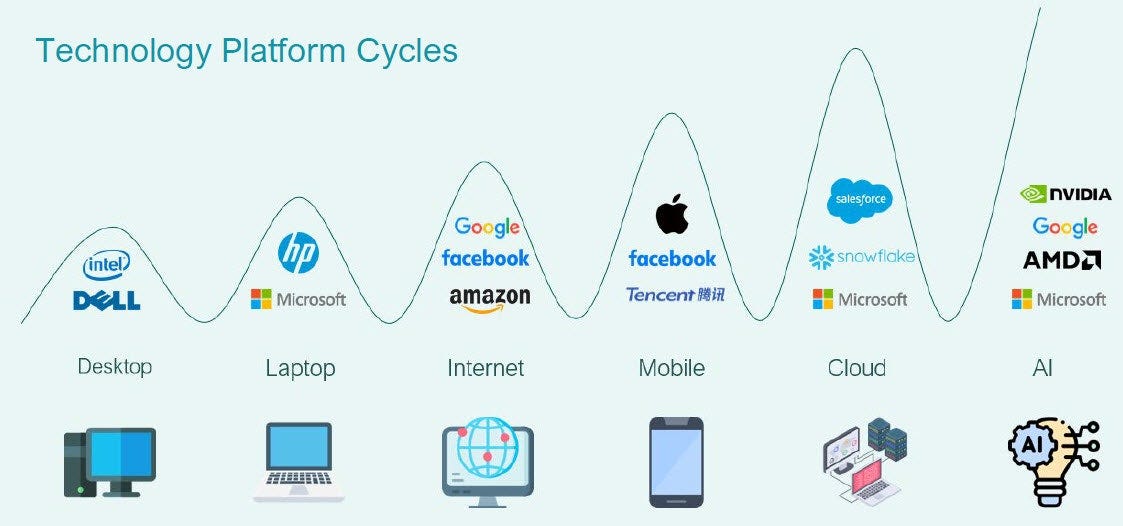

As an industry, the world of venture capital is highly reliant on large scale platform shifts every so often to give entrepreneurs new tools to solve problems with. These platform shifts welcome in a wave of innovation and accordingly can produce some of the best fund vintages. While I don't think we've solved every problem there is to solve with currently available technology (far from it), we have been innovating on cloud and mobile since the mid to late 2000s. By nature, over time the number of multi billion dollar whitespaces does start to shrink as a result of folks building massively successful companies. This then begs the question though - is AI truly the next platform shift and if so, does it have the potential to produce a similar scale of venture returns to cloud and mobile? While it’s tough to dispute the technological progress that LLMs represent, I'm not convinced this current hype cycle is equitable to cloud and mobile in terms of dollars that will be returned to LPs.

Cloud and mobile ushered in one of the greatest eras of tech innovation in the early 2010s. Uber, Stripe, Instagram, Airbnb, Square, Pinterest, and many more were all built on one or both of these innovations. Realistically though, both cloud and mobile were both pure infrastructure, in that they served wholly as building blocks upon which entrepreneurs could innovate. Sure, Apple did have their own native apps, but the app store by nature was designed to allow folks to build their own products and serve as a means of distribution. Similarly, AWS didn't build any end customer facing applications but rather offered folks a far more efficient way to store data. This meant both served as foundational tools for entrepreneurs to build on.

Generative AI doesn't quite operate this way. In many cases, the inherent value proposition behind an AI-first solution is the ability for end users to engage with or leverage an LLM. By definition, this strikes a stark contrast to the aforementioned technologies, in that the core infrastructure provider also plays a key role in actual product delivery at the application layer. The product that an end customer interacts with is now actually owned in large part by the infrastructure provider. It stands to reason then that more value should accrue to 1) the LLM providers themselves, 2) companies who have access to vast amounts of data to uniquely train models to maximize their utility, and 3) companies who can help facilitate this usage of data for LLMs in a safe, secure, and compliant manner. We've seen large enterprises launch their own AI products by going directly to an LLM provider. Morgan Stanley launched a copilot for its advisors in partnership with OpenAI. Marsh has done so as well. Oracle released over 50 AI products within its existing suite in partnership with Cohere. Maybe there are certain products where a net new startup can gain access to a superior dataset to train a model on, but this is a tall task. It's also striking to see just how quickly these massive enterprises were able to get something off the ground. While it still remains to be seen just how effective these tools are, development speed here is quite eye opening for incumbents of their size.

Of course, this doesn't take away from the immense value that LLMs can actually provide. As far as general utility goes, these products often do represent step-function-like improvements in terms of our ability to address problems and improve automation. I fully expect the majority of startups to launch some sort of AI component to augment their capabilities. The question, though, becomes how many opportunities are there for startups to leverage this innovation in ways that are defensible enough to create the massive, home run type outcomes that the venture ecosystem relies on? While I'm not arguing that this sort of outcome is impossible to achieve now, I do think that as technical differentiation and barriers to entry continue to shrink, creating businesses with enough defensibility to become truly category defining businesses becomes ever more challenging. If you think I'm wrong, would love to chat about it!